The Covid 19 impact: Mixed economic impact on South Asian countries

While South Asia has to grapple with deep-seated inequalities and vulnerabilities, the pandemic also provides an opportunity to find a path towards a more equitable and robust recovery, writes Partha Pratim Mitra for South Asia Monitor

South Asia has faced one of the most severe impacts of Covid 19. The Asian Development Bank (ADB) in its latest edition of Basic Statistics[i]published in April 2021 has provided information on various economic and social indicators for the Asia and Pacific region in 2020.

We have chosen some indicators and divided them into positive and negative. We have described as positive indicators those that witnessed a positive trend amidst the pandemic. Some other indicators have got negatively impacted by the Covid 19 crisis or have by themselves negatively impacted the battle against the pandemic. We have therefore described them as negative or negatively impacted indicators.

Macro-economic indicators

We begin with the first of the positive aggregate macro-economic indicators - the per capita nominal GDP in USD which, despite the pandemic, countries of the region have achieved in 2020. The trends for the countries in South Asia are Maldives (6785), Sri Lanka (3681), Bhutan(3333), India (1947), Bangladesh (1942), Pakistan (1222), Nepal (1134) and Afghanistan (678).

We next take a negative macro-economic indicator which is the annual growth of GDP in percentage in 2020 to see the extent of the pandemic impact. The trends for the countries in the region are - Bangladesh (5.2), Bhutan (0.9), Pakistan(-0.4), Nepal (-1.9), Sri Lanka (-3.9), Afganistan (-5.0), India (-8.0) and Maldives (-32.0).

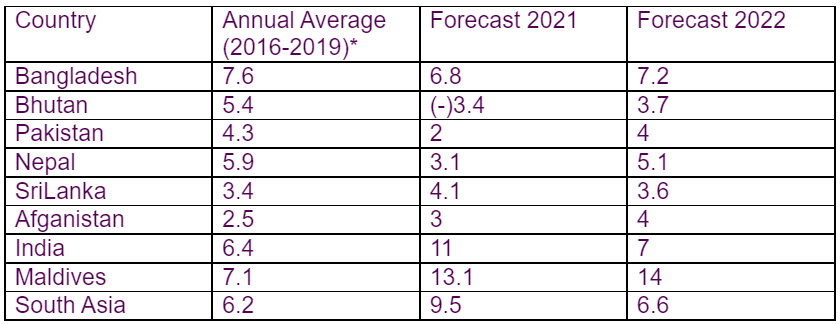

Table - Real GDP Growth in South Asia in perspective

Source: Asian Development Outlook(ADO),ADB,April 2021,*Estimated

Most countries in South Asia witnessed a sharp downturn in 2020 and are expected to recover in 2021 and 2022. There are two exceptions - Bangladesh for its performance in 2020 and Bhutan for its negative outlook in 2021. Economic growth in Bhutan, unlike most other countries in the region, is expected to contract by 3.4 percent in 2021 from a positive of 0.9 percent in 2020 on account of stringent pandemic containment measures, including two prolonged nationwide lockdowns that reduced economic activity across sectors.

Bangladesh, despite the Covid 19 pandemic, expanded by an estimated 5.2 percent in 2020. It has attempted to soften the impact of the pandemic, and accelerated economic recovery by offering: (i) salary support to workers in export-oriented industries; (ii) special honorariums for medical professionals; (iii) concessional loans to industries, including cottage, micro, small, and medium-sized enterprises; and (iv) extended social protection assistance.[ii]

Sectoral impact

The pandemic has impacted various economic sectors of different countries in the region. In our data analysis, sectors that have grown regardless ofS the pandemic have been attributed as positive factors, while sectors registering negative growth rates are described as facing the negative fallout of the pandemic. AThe griculture seems to have emerged as a positive sector despite the pandemic as compared to the industry or services sectors.

Bangladesh in this group of countries has been the lone exception registering positive growth rates in 2020 in all three sectors notwithstanding the pandemic. It shows the country has ensured the pandemic effect got outweighed not only by the growth impulses in the agriculture sector but also by extending the growth momentum to industry and the services sectors, unlike most countries. Bhutan is an exception as it registered positive services sector growth despite the pandemic.

The data for sectoral annual real growth on value-added for countries in South Asia in 2020 for agriculture shows Maldives (6.4 percent) ahead, followed by Afganistan (5.0 percent), Bangladesh(3.1 percent), India (3.0 percent), Pakistan (2.7 percent), Bhutan (2.6 percent), Nepal (2.2 percent) and Sri Lanka (-2.4 percent).

The trends for growth on value-added for the industrial sector in these countries show leaders Bangladesh (6.5 percent) followed by Bhutan (-1.1 percent), Pakistan (-2.9 percent), Afganistan (-5.0 percent), SriLanka (-6.9 percent), Nepal (-4.2 percent), India(-8.2 percent) and Maldives (-21.3 percent).

The trends in annual real growth rates in value-added for the services sector for countries in South Asia for 2020: Bangladesh (5.3 percent), Bhutan(3.8 percent) Pakistan(-0.6 percent), SriLanka (-1.5 percent), India (-8.1 percent), Afganistan(-9.6 percent), Nepal (-3.6 percent) and Maldives (-32.7 percent).

Gross domestic investment as a percentage of GDP is a positive indicator if it has shown positive trends despite the pandemic. Most countries of the region have utilized domestic investment to propel their economies out of the pandemic. The trends in Gross domestic investment for countries of the South Asia region for 2020 show Bhutan (33.7 percent) leading the pack, followed by India (32.2 percent), Sri Lanka (25.2 percent), Bangladesh (31.8 percent),Nepal(31.3 percent) and Pakistan (15.4 percent).[iii]

Now we may turn to sectoral indicators which are considered to be positive. Even in the pandemic situation, countries of the region have done well in government revenue, expenditure and fiscal balance. The trends for government revenue as a proportion of GDP in 2020 for countries of the region are Bhutan (29.3), Afganistan (27.0), Maldives (25.4), Nepal (21.8), Pakistan (14.3), Sri Lanka (9.6), Bangladesh (9.4) and India (8.2).

Trends in government expenditure as a proportion of GDP in 2020 for the SA countries are Maldives (52.9), Bhutan (32.0), Afganistan (29.5) Nepal (29.1), Pakistan (23.5), SriLanka (21.5), India (17.7) and Bangladesh(14.9).

Trends in Fiscal balance as a proportion of GDP for 2020 for South Asia are Afganistan (-2.5), Bhutan (-2.7), Bangladesh and Nepal (-5.5), Pakistan (-9.1), India (-9.5), SriLanka (-11.9) and Maldives (-27.5).

External trade sector impact

One set of sectoral indicators which have taken the impact of the pandemic is the external trade sector and therefore we call them negatively impacted indicators. Trends in percent growth of merchandise exports have been - Bhutan (6.7), Pakistan (-7.2), Nepal (-7.5), Afganistan (-10.1), India (-11.9), SriLanka (-15,9), Bangladesh (-17.1) and Maldives (-39.1),

Trends in percent growth of imports in 2020 are as follows: Bangladesh (-8.6), Bhutan (-11.8), Afganistan (-14.5), Pakistan (-18.2), Nepal (-18.9), Sri Lanka (-19.5), India (-20.7) and Maldives (-37.7).

Trends in trade balance as a proportion of GDP for 2020 have been - India (-3.7), Bangladesh (-5.4), Sri Lanka (-7.4), Pakistan (-7.5), Bhutan (-9.8), Afghanistan (-23.9), Nepal (-26.9) and Maldives (-37.7).

The current account balance, which is another external sector indicator concerning the county’s overall balance of payments affected by the pandemic, shows that in 2020 the situation for the South Asian countries as a proportion of GDP has been Afganistan (10.7). India (1.0), Sri Lanka (-0.3), Nepal (-0.9), Pakistan (-1.1), Bangladesh (-1.5), Bhutan (-12.1) and Maldives (-29.2).

Remittance from overseas constitutes an important part in improving the current account balance of countries. For the South Asian region, which depends to a large extent on external remittances from abroad, the estimated trends of the share of remittances in the GDP for 2020 is Nepal (22.6), Pakistan (9.1), SriLanka (7.6), Bangladesh (6.2), Afghanistan (4.1), India (2.9), Bhutan (2.1), Maldives (0.1) [Source Labour Migration in Asia Impacts of Covid 19 Crisis and Post-Pandemic future, ADB Institute, OECD, ILO.29 April 2021www.ilo.org].

Most countries in the South Asian region have high population densities that act as a factor negatively impacting the battle against Covid 19 pandemic. These countries are known to have a large number of people living in urban slums.[iv]

The high density of population facilitates the spread of the virus if protocols are not followed. On the other hand, it becomes difficult to follow the protocols in locations that have a high density of population. The trends for density of population measured in terms of persons living in one square kilometer of the surface area in 2020 were Maldives (1858), India (412), Sri Lanka (334), Pakistan (272), Nepal (203), Bangladesh (151), Afganistan (48) and Bhutan (20).

The pandemic has affected the employment and livelihoods of countries and more so of those nations in South Asia that have large informal sectors. The rates of unemployment that a number of these countries have witnessed are a direct impact of the pandemic and therefore could be considered as one of the negatively impacted indicators. The trends for South Asia in 2020 are as follows: Bhutan (3.7 percent) Nepal (4.4 percent), Pakistan(4.7 percent), SriLanka (4.8 percent), Bangladesh (5.3 percent), India (7.1 percent), Maldives (7.2 percent) and Afganistan (11.7 percent).

Linked with the question of unemployment and loss of livelihoods is the age dependency ratio of countries. The age-dependency ratio, which is a measure of the financial burden borne by the working population due to persons in the household dependent on them, is likely to increase with employment and livelihood opportunities shrinking during the pandemic. The ratio is often used to measure the financial pressure on the active working population of a country. The higher the ratio, the greater would be the burden that is carried by working-age groups of people. A low ratio would imply more people are working who can support the population which depends on them. The trends for age-dependency ratio as a percent of the working population for countries in the region in 2020 were Maldives (30), Bhutan(45), Bangladesh (47), India (49), Nepal (53), SriLanka (54), Pakistan (64) and Afganistan(80). The global age dependency ratio in 2019 was 54.[v]

The various indicators show that despite the ravaging effects of the pandemic, some South Asian countries have faced the challenges in a more robust manner than others. The focus areas that enabled these countries to tackle the challenges better have been agriculture, government revenues and expenditure, and in some cases comfortable foreign exchange reserves and growth in export earnings.

With most countries of the region not having the legacy of a growing external debt burden, as shown by the data which follows, management of the external sector has been by and large cautious without triggering an alarming concern in the region. The data on debt service as a percentage of exports of goods and services for 2019 in the region are - Bhutan (2.2), Afghanistan (2.4), India (2.9), Bangladesh (4.1), Nepal (7.3), Maldives (11.0), SriLanka (25.4) and Pakistan (31.1).

The data on outstanding external debt as a percentage of Gross National Income for countries of the South Asian region are Afghanistan (5.7), Bangladesh (12.2), Bhutan (13.9), Nepal (17.3), India (19.3), Sri Lanka (23.4), Maldives (29.9) and Pakistan(34.9).

The big worry for South Asia is that the Covid crisis has devastated livelihoods across the region, wiping out many years of progress on achieving the Sustainable Development Goals of the UN. It is estimated that nearly two out of five of 2020’s new global poor are in South Asia.[vi]

While South Asia has to grapple with deep-seated inequalities and vulnerabilities, the pandemic also provides an opportunity to find a path towards a more equitable and robust recovery. To that end, governments need to work on universal social insurance to protect informal workers, increase regional cooperation, lift trade restrictions on key staples wherever necessary to prevent sudden spikes in food prices[vii]

The challenges are in the smooth implementation of policy measures. The crux of the matter lies in the critical need to recognize the problems and embark on a cogent set of policy measures that are inclusive in their approach in which all sections of the society and all nations of the region participate.

REFERENCES

[i] Basic Statistics. 2021. Publication. Available from:https://www.adb.org/publications/basic-statistics-April2021,P1-6

[ii] ASIAN DEVELOPMENT BANK MEMBER FACT SHEETBANGLADESHn April 2021https://www.adb.org/sites/default/files/publication/27753/ban-2020.pdf

[iii]Data for Afghanistan and Maldives are not available.

[iv]KritiKapur Et al, COVID 19, The New South Asian Enigma, ORF, Sep16,2020. Available from: https://www.orfonline.org/expert-speak/covid19-the-new-south-asian-enigma-73553/

[v] https://data.worldbank.org/indicator/SP.POP.DPND

[vi]World Economic Situation and Prospects 2021: South Asia p 106-107, January 2021. Available from: https://www.un.org/development/desa/dpad/wp-content/uploads/sites/45/WESP2021_CH3_SA.pdf

[vii] South Asian Economies bounce back but face Fragile Recovery. March 31, 2021. Available from: https://www.worldbank.org/en/news/press-release/2021/03/31/south-asian-economies-bounce-back-but-face-fragile-recovery

Post a Comment